It had 4000 in profits and paid. If you can find all this information essentially all you need to do to calculate retained earnings is follow this formula.

Statement Of Retained Earnings Overview Uses How To Set Up

Statement Of Retained Earnings Overview Uses How To Set Up

What are retained earnings.

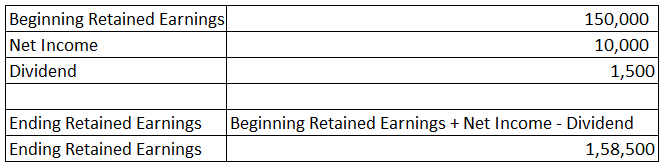

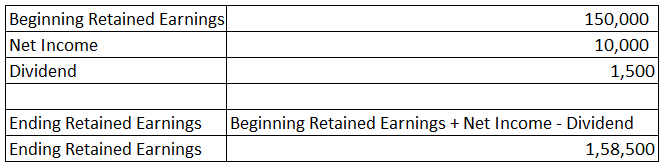

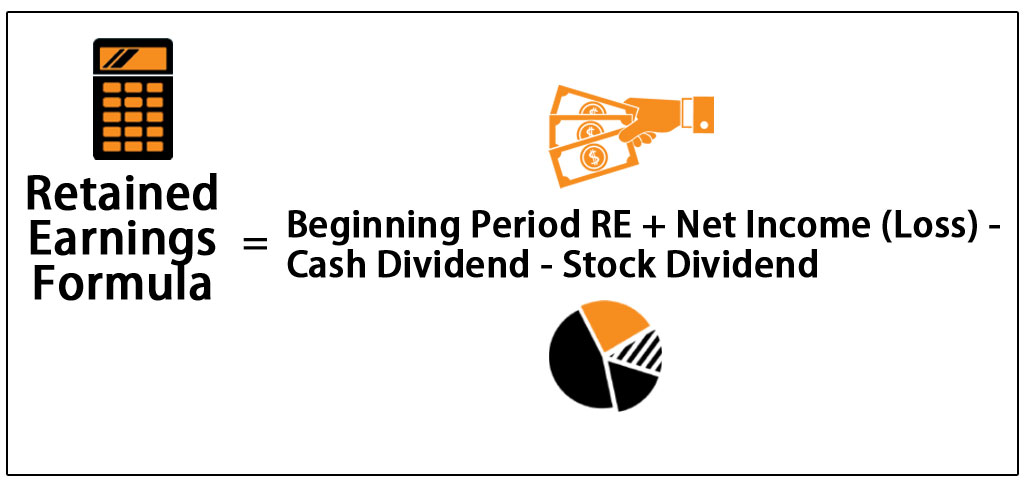

Beginning retained earnings equation. Next to find the businesss cumulative retained earnings add the retained earnings value you just calculated to its most recent retained earnings balance. Retained earnings are defined as the cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company and it is shown as the part of owners equity in the liability side of the balance sheet of the company. The expanded accounting equation is derived from the common accounting equation and illustrates in detail the different components of stockholders equity of a. Formula to calculate retained earnings. That are not distributed as dividends to. Net income dividends paid out retained earnings. Beginning retained earnings retained earnings dividends profit loss for example assume a companys income statement shows 12000 in retained earnings. Retained earnings formula calculates cumulative earnings earned by the company till the date after adjusting for the distribution of the dividend or the other distributions to the investors of the company and it is calculated by subtracting the cash dividends and stock dividends from the sum of beginning period retained earnings and the cumulative net. And the company is planning to issue dividends to the shareholders of 2000. Retained earnings refer to the percentage of net earnings not paid out as dividends but retained by the company to be reinvested in its core business or to pay debt. Instead it is retained for investments in working capital andor fixed assets as well as to pay down any liabilities outstanding. While it is arrived at through the income statement the net profit is also used in both the balance sheet and the cash flow statement. Lets assume anand group of companies have shown following details as per its financials for the year ended 2017 18. It is recorded under. Beginning retained earnings of the company is 200000 the company has reported net income of 20000.

How To Create A Statement Of Retained Earnings For A Financial

How To Create A Statement Of Retained Earnings For A Financial

What Are Retained Earnings Guide Formula And Examples

What Are Retained Earnings Guide Formula And Examples

Types Of Businesses Balance Sheet Is Sre Scf 100 100 100 100

Types Of Businesses Balance Sheet Is Sre Scf 100 100 100 100

14 4 Compare And Contrast Owners Equity Versus Retained Earnings

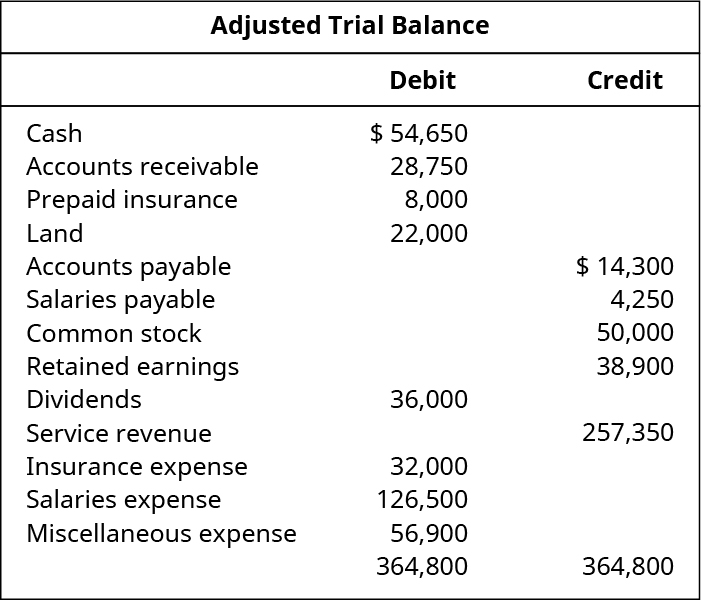

Prepare Financial Statements Using The Adjusted Trial Balance

Prepare Financial Statements Using The Adjusted Trial Balance

Retained Earnings What Are They And How Do You Calculate Them

Retained Earnings What Are They And How Do You Calculate Them

Retained Earnings On The Balance Sheet Meaning Examples

Retained Earnings On The Balance Sheet Meaning Examples

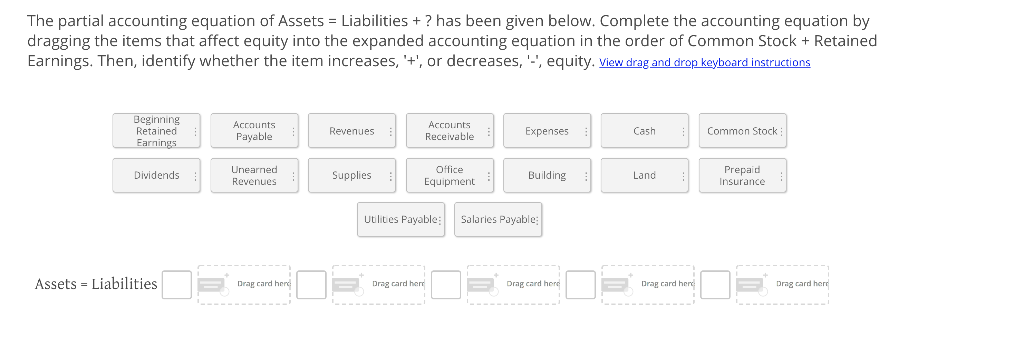

Solved The Partial Accounting Equation Of Assets Liabilit

Solved The Partial Accounting Equation Of Assets Liabilit

Retained Earnings Formula How To Calculate Step By Step

Retained Earnings Formula How To Calculate Step By Step