The resulting amount should equal box 3 social security wages and box 5 medicare wages on your w 2. You can calculate adjusted gross income using your w2 if you know the expenses you plan to use to offset the income.

W 2 Form Fillable Printable Download Free 2019 Instructions

W 2 Form Fillable Printable Download Free 2019 Instructions

Once youve calculated your earnings for the year you can select the appropriate tax form add your expenses subtract them from your income and calculate your agi.

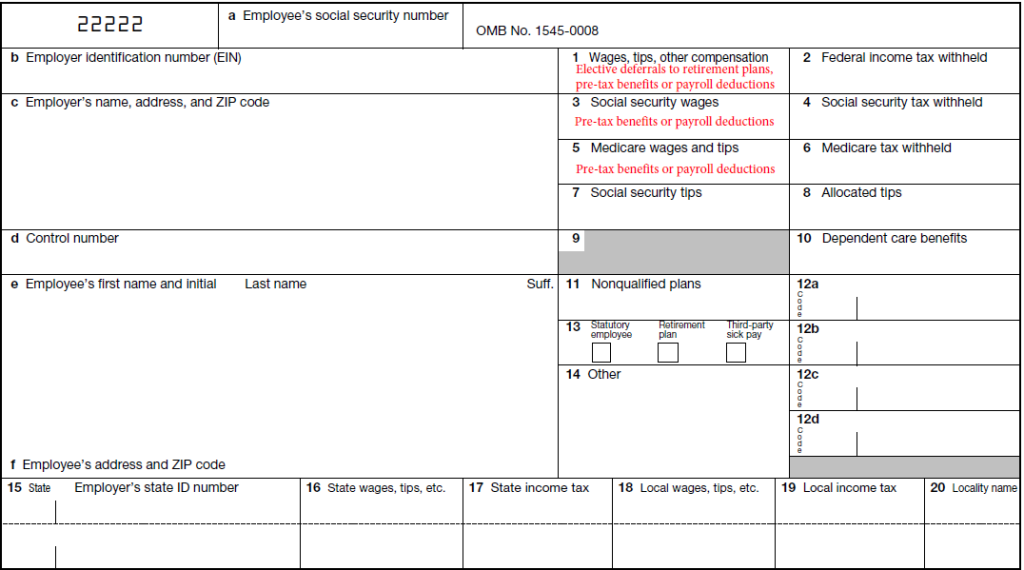

Gross earnings on w2. It is the amount of all gross installments of. It details your gross income and all the tax. The form also includes social security and medicare. 1 w 2 obligations for employers. Your pay stub and irs form w 2 include gross income data but for different reasons. If youre an employee one of those forms is the form w 2 wage and tax statementno matter. While your pay stub shows total wages paid to you your w 2 shows gross taxable wages. Ordinarily your gross pay is all of your income before any deductions are taken out. Typically this is followed by a list of deductions such as income taxes and the. Boxes 1 3 5 16 and 18 are all wages boxes on the w 2 form. On a w 2 tax statement an employees federal taxable gross wages appear in box 1 which is located near the top center of the form. This may confuse employees whose annual salaries and w 2 wage reporting dont match. With tax season in full swing you probably have a number of tax forms either in hand on on the way. What items are deducted from gross income on a w 2. Gross earnings for an individual are generally the first line of an employees gross earnings on a paycheck stub.

Gross Wage Calculation Defined Contribution Plan Auditor 401k

Gross Wage Calculation Defined Contribution Plan Auditor 401k

What Was Your Adjusted Gross Income For 2017 Federal Student Aid

What Was Your Adjusted Gross Income For 2017 Federal Student Aid

Form W2 Everything You Ever Wanted To Know

Form W2 Everything You Ever Wanted To Know

Adjusted Gross Income Where To Find Agi On W2

How To Calculate W 2 Wages From Pay Stub

How To Calculate W 2 Wages From Pay Stub

Schedule Se 1040 Year End Self Employment Tax

Schedule Se 1040 Year End Self Employment Tax

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

Dealing With A Missing W 2 Or Using Form 4852 Instead Don T Mess